Unlock Alternative Financing Options: A Guide to Private Mortgages

A Guide to Private Mortgages

Introduction

The path to homeownership isn't always straightforward. Traditional mortgages have strict eligibility criteria, leaving some borrowers feeling shut out. Private mortgages, also known as alternative mortgages, offer a potential solution.

What are Private Mortgages?

Private mortgages are loans secured by your property but funded by private individuals or entities instead of banks or credit unions. These lenders often have more flexible eligibility requirements compared to traditional lenders.

Benefits of Private Mortgages:

- Access to Funding: Qualify for a loan even if you have imperfect credit, self-employment income, or other factors that might hinder a traditional mortgage approval.

- Faster Closing Times: Private lenders often have a less bureaucratic process, leading to quicker loan approvals and closings.

- Flexible Terms: Negotiate loan terms that better suit your unique financial situation, such as shorter repayment periods or interest-only options.

Things to Consider with Private Mortgages:

- Higher Interest Rates: Private lenders typically charge higher interest rates than traditional lenders due to the increased risk associated with borrowers who may not qualify for conventional loans.

- Fees: Be mindful of potential origination fees, application fees, and other closing costs associated with private mortgages.

- Shorter Terms: Private mortgages often have shorter loan terms compared to traditional mortgages, requiring a higher monthly payment.

- Due Diligence: Thoroughly research and choose a reputable private lender to ensure a secure and transparent transaction.

When Might a Private Mortgage Be Right for You?

- You need financing quickly and a traditional mortgage application process seems too slow.

- You have a unique financial situation that doesn't fit the typical mold for conventional lenders.

- You're a self-employed borrower with income that might be difficult to document for traditional lenders.

- You're looking for a short-term financing solution for a specific purpose, like renovations or a bridge loan.

Finding a Reputable Private Lender:

- Seek referrals: Ask real estate agents, financial advisors, or other professionals in your network for recommendations of reputable private lenders.

- Research online lenders: While online research requires caution, it can help you compare rates and terms offered by different private lenders.

- Focus on transparency: Choose a lender who clearly explains loan terms, fees, and the entire lending process.

- Ask questions: Don't hesitate to ask about the lender's experience, licensing, and any specific requirements they have for borrowers.

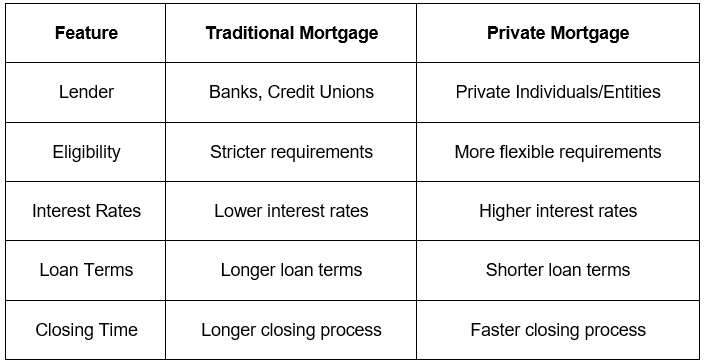

Private Mortgages vs. Traditional Mortgages:

Conclusion

Private mortgages can be a valuable tool for homeowners who need alternative financing options. By understanding the benefits, risks, and key considerations, you can make an informed decision about whether a private mortgage is the right fit for your financial situation.

Remember, it's crucial to compare rates and terms from multiple lenders and choose a reputable provider to ensure a secure and successful experience.